Car insurance is essential for protecting your vehicle, your finances, and yourself. However, with so many options, finding the right policy can feel overwhelming. This guide will help you understand the key aspects of car insurance and how to choose the best plan for your needs.

Table of Contents

- What Is Car Insurance?

- Types of Car Insurance Coverage

- Factors to Consider When Choosing Car Insurance

- Tips for Finding Affordable Car Insurance

- Common Car Insurance Terms Explained

- Frequently Asked Questions

What Is Car Insurance?

Car insurance is a contract between you and an insurance company. You pay premiums, and in return, the company provides financial protection against damage, theft, or accidents. It also helps cover costs related to injuries, legal issues, or damages caused to others.

Types of Car Insurance Coverage

Understanding the types of coverage is crucial to picking the right policy. Here are the common options:

1. Liability Insurance

This is mandatory in most places. It covers:

- Bodily Injury Liability: Pays for injuries you cause to others.

- Property Damage Liability: Covers damages to another person’s property.

2. Comprehensive Coverage

Protects against non-collision-related incidents, such as:

- Theft

- Natural disasters

- Vandalism

3. Collision Coverage

Pays for damage to your vehicle from collisions with another car or object, regardless of fault.

4. Personal Injury Protection (PIP)

Covers medical expenses for you and your passengers, regardless of fault.

5. Uninsured/Underinsured Motorist Coverage

Protects you if you’re in an accident with a driver who lacks adequate insurance.

6. Gap Insurance

Covers the difference between your car’s value and the amount you owe on it.

Factors to Consider When Choosing Car Insurance

Selecting the right policy depends on your needs and budget. Consider these factors:

1. Coverage Needs

Assess the types of coverage you need based on your driving habits, car value, and risk factors.

2. Premium Costs

Compare prices but ensure the policy covers all your requirements. Lower premiums might mean limited coverage.

3. Deductibles

This is the amount you pay out of pocket before your insurance covers the rest. Higher deductibles mean lower premiums but more expenses during claims.

4. Policy Limits

Understand the maximum amount your insurer will pay for each type of coverage.

5. Discounts

Ask about discounts for safe driving, bundling policies, or being a good student.

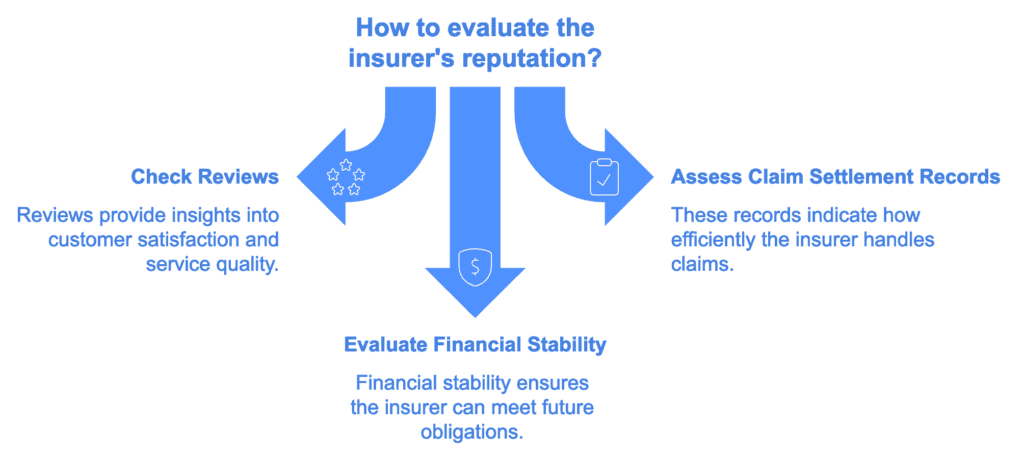

6. Reputation of the Insurer

Check reviews, claim settlement records, and financial stability of the company.

7. Customer Service

Reliable customer support is essential for resolving issues quickly.

Tips for Finding Affordable Car Insurance

Getting affordable car insurance without compromising coverage is possible. Follow these tips:

1. Shop Around

Compare quotes from multiple insurers to find the best deal.

2. Bundle Policies

Combine car insurance with other types, like home or renter’s insurance, for discounts.

3. Improve Your Credit Score

A good credit score can lead to lower premiums.

4. Choose a Higher Deductible

Opt for a higher deductible if you can afford it to reduce premium costs.

5. Drive Safely

Maintain a clean driving record to qualify for discounts.

6. Reduce Coverage on Older Cars

For older cars, consider dropping collision or comprehensive coverage if repair costs exceed the vehicle’s value.

Common Car Insurance Terms Explained

- Premium: The amount you pay for your insurance policy.

- Deductible: The amount you pay out of pocket before insurance kicks in.

- Claim: A request to your insurer for compensation after an incident.

- Policy Limit: The maximum amount an insurer will pay for a covered loss.

- Exclusion: Situations or damages not covered by the policy.

Frequently Asked Questions

1. How much car insurance do I need?

The minimum required depends on your location. However, additional coverage like comprehensive or collision might be worth considering for better protection.

2. What affects car insurance rates?

Factors include age, driving history, location, car type, and credit score.

3. Can I switch insurers anytime?

Yes, but check for cancellation fees or waiting periods in your current policy.

4. Is it worth getting gap insurance?

Gap insurance is helpful if you owe more on your car loan than the car’s market value.

5. How can I lower my premiums?

Maintain a clean driving record, improve your credit score, and ask for discounts.

By following this guide, you’ll be better equipped to choose a car insurance policy that meets your needs and fits your budget. Always read the policy details carefully and ask questions to ensure you’re fully covered.